It’s Almost July of this year. What’s so special in July, you may ask.

Naaa.. It’s not my birthday and it’s not my son’s birthday.

This is the time I have to shell out a huge chunk of money for my car insurance. Year after Year, each year.

Now if I am so much worried about my Car’s insurance premium, Imagine about the ship owners.

Imagine how much money they need to pay for the insurance of their ships. But that is the cost they cannot avoid.

These costs are for the insurance of ship’s hull and machinery. The good part in this insurance is that costs are known to the shipowner and they can plan for that.

But when a ship is navigating at sea, carrying cargo and is involved in all these activities, it is subjecting itself to a number of claims against the ship owners.

For example, a port can claim that ship damaged its fenders or a buoy while berthing. Or the port can claim that ship polluted their waters.

So it is not about only insurance of damage to the hull and its machinery but also about all the claims that ship owner can get against him.

There can be a number of other kinds of claims. Some logical and some illogical. But ship owners have to make sure that they are insured for all of these.

In this post, we will discuss where P&I clubs fit in the marine insurance and how do these work.

Let us jump in.

Where do P&I clubs fit in marine insurance?

Broadly there are three types of marine insurance.

- Insurance for the ship (Hull and Machinery)

- Insurance for the cargo (Taken by the shipper)

- Insurance for the third party claims

Hull & Machinery policy

Insurance for the ship’s hull and machinery is provided by H&M underwriters. This is the oldest kind of marine insurance and most basic one too.

This is the insurance for the damage to the ship’s hull and machinery.

H&M insurance policies have few important clauses that shipowners have to abide by.

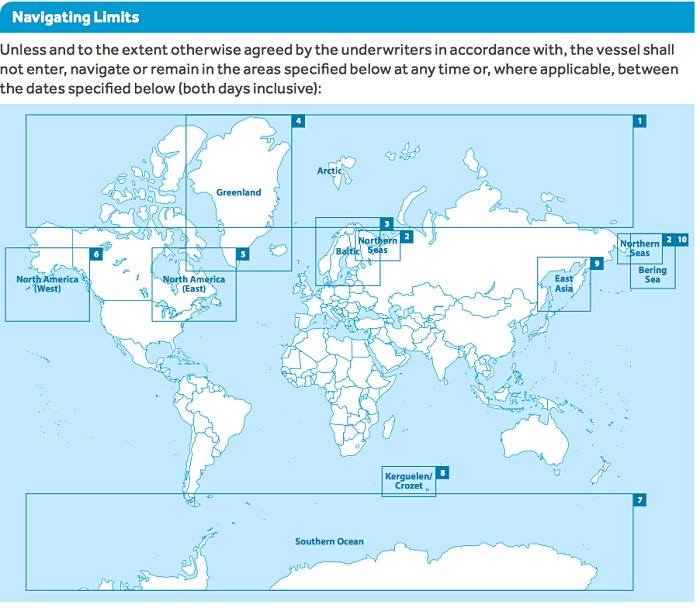

For example, H&M policy has International Navigation Limits. The international navigation limits define the geographical limits within which the ships can trade without any additional premium.

Another example, H&M policy restricts the ship to proceed to war zones without informing the H&M underwriters. Again, this is because of additional risk that these areas pose.

Cargo insurance

The shipper has shipped the cargo and the cargo gets damaged during the voyage. Can shipper claim all the costs from the shipowner or carrier?

If you understand the “Hague-Visby rules” you will know that these rules provide many defenses to the shipowner.

So if these defenses apply to a case, the shipper would have nobody to claim these damages from.

This is the reason that shipper insures the cargo at each leg of the voyage.

P&I Insurance

P&I insurance is used for the third party claims towards the ship owners. Shipowners provide a service of carrying the cargo of the shipper.

While providing this service, a shipowner may be subjected to a number of claims from third parties.

These claims could be damage to the jetty, pollution from the ship or even the fines to the ship from authorities.

Shipowners need to insure for all these third party claims. P&I clubs provide insurance to the shipowners for all these claims.

Why P&I Clubs?

Before the 19th century, the term “marine insurance” only meant the insurance for the ship’s hull and machinery.

This was the time when most of the ships were sailing vessels.

The chances of collision between two sailing vessel’s were less. But as more and more steamships came to the sea, the chances of collision between ships increased.

Underwriters became concerned about this increased risk. Rightly so because in collisions between two vessels, H&M insurers not only have to cover the damages of the insured ship but also pay for the damages of the other ship if the blame is on the insured vessel.

To take care of part of this risk, they introduced a clause in their policies.

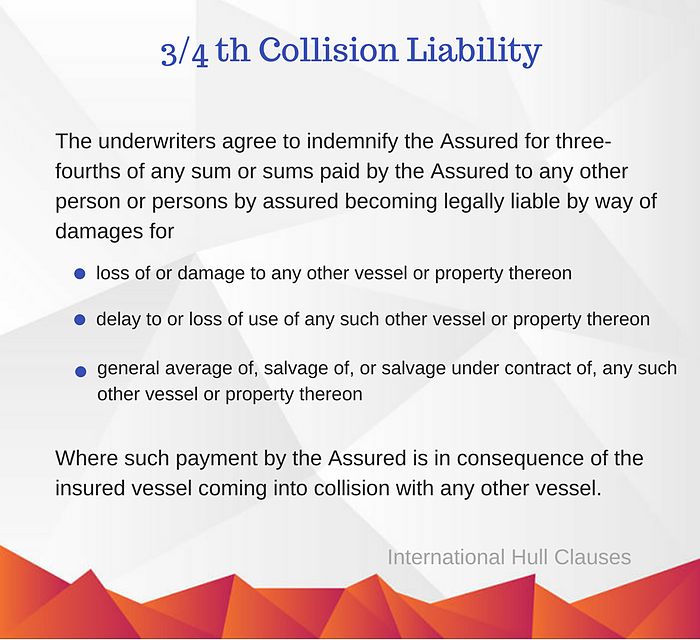

This clause was called “3/4th Collision Clause” or “Running down clause“. As per this clause, the underwriters will only pay 3/4th of the total liability or claims against the ship owners in a collision incident.

This clause is there in the Hull & Machinery policies even today.

Let us see this with an example. Let us say there has been a collision between two ships. The “hull & machinery insurance” of both the ships will study the investigation of the collision to set up the percentage of blame.

Let us say the blame was set as below

Ship A: 70% responsible for the collision

Ship B: 30% responsible for the collision

The repair costs for both the ships are as follows

Ship A: USD 100,000

Ship B: USD 250,000

Total cost of repairs: USD 350,000

The liability of both the ships will be

Ship A: USD 245,000 (70% of the total costs)

Ship B: USD 105,000 (30% of the total costs)

So ship A need to pay USD 145,000 to ship B apart from USD 100,000 damages to its own ship which will be covered by H&M insurance.

As per 3/4th collision clause, the H&M insurance company will pay only 3/4th of this amount.

So payable by H&M insurance: USD 108,750

Payable by shipowner: USD 36,250

The ship owners wanted to insure this amount too without exorbitantly increasing their insurance premium.

Shipowners could get this 1/4th liability insured but for that, they needed to pay an additional premium. Shipowners wanted to avoid that.

This led to the formation of P&I clubs which works on the principle of mutual sharing or pooling of the risk.

With time the P&I clubs insured many other risks the owners were subjected to in their business of running the ships.

How do the P&I clubs work?

P&I clubs work on a non-profit basis. It is the club of shipowners who are acting both as assured and insurers.

P&I clubs work on the principle of mutual sharing and pooling of the risk.

What does this mean? Let us understand this with a simple and most basic example.

10 shipowners form a club for sharing each other’s risk. All these 10 shipowners have one ship each which is of the same type, size and value.

At the end of the year, one ship had third party claim of USD 1000 to pay. This claim of USD 1000 will be shared by all the 10 shipowners equally.

So each shipowner would contribute USD 100 to pay this claim. This means that with just USD 100, each shipowner was able to cover the risk of the third party claims.

Now that we know the basic principle of working of P&I clubs, let us understand few basic terms used in P&I clubs.

Calls

In more realistic situation P&I club cannot afford to ask the contribution of each owner only when there are some claims to settle.

In our example, the claim of USD 1000 would need to be paid immediately to avoid the delays to the ship. This means that P&I club needs to have money in its account to pay for the third party claims.

P&I clubs maintain a fund and ask the shipowners to contribute to this fund

- when a new shipowner joins the club or

- when the fund money goes down because of the claims settles.

- Annually or as per the rules of the P&I Club

All these requests to the shipowners for the payment are called “Calls”.

So these may be

- Advance calls (Paid when a shipowner joins the club or at the beginning of year)

- Supplementary calls (Paid when the funds have gone down because of claims paid )

- Release calls (to settle the account of a ship that is sold or scraped or shipowner leaves the P&I club)

Deductibles:

Deductibles in a claim is a common practice in all kind of insurances.

The deductible is the pre-set amount deducted from the insured loss.

Let us say that a P&I club has set the deductibles for claims arising from damage to the jetty as USD 5000.

Now if the claim towards the shipowners for one of such incident is USD 30000. Then the P&I club would pay USD 25000 after USD 5000 as deductible from this claim.

Deductible serves two purposes

- It discourages the shipowners from claiming the small amounts.

- It ensures that shipowners have increased interest in minimizing the casualties and claims

Now let us see this from the perspective of a ship owner who just bought a ship and needs to enter a P&I club.

A new shipowner entering into the club

It is important for the shipowner to insure all risk involved with the operation of a ship. Apart from “Hull & Machinery” insurance, entry of the ship into a P&I club is important.

So the ship owner would first approach the P&I club for including him and his ship into the club.

The P&I Club will assess all the factors before deciding if it is OK to include this ship owner and this ship into the club. Some of the factors the club would be looking for are

- Suitability of the cargo spaces for the intended cargo

- Proficiency of the crew

- previous track record of the ship owner and/or Ship managers

- Standards of classification society

Once the club decides that the ship can be covered, the details of the cover provided by the club would be shared with the ship owner.

The details would include the call rate and deductibles for each type of risk. Call rate is expressed as amount per gross tonnage.

If agreed the ship owner will pay the “advance call” and P&I club will issue the “certificate of entry” to the ship owner.

Finances of a P&I club

Let us see how the finances of a P&I club are handled?

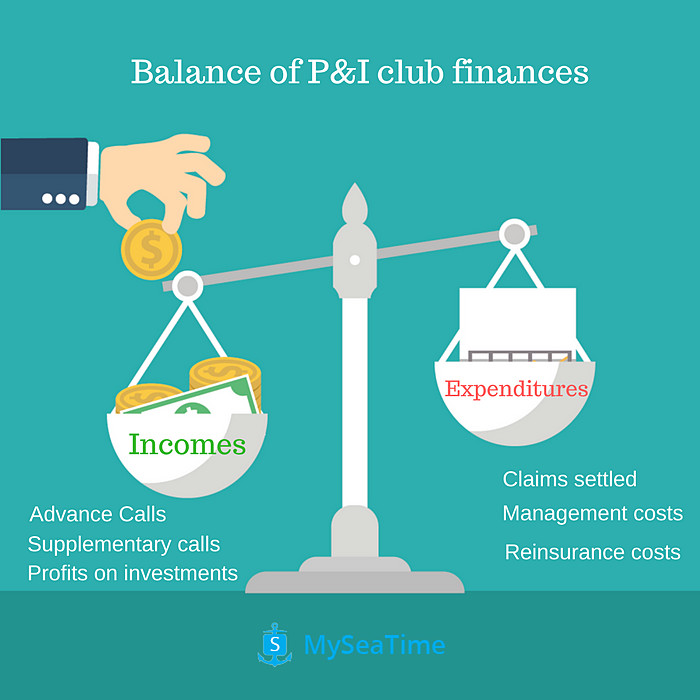

Incomes

As discussed, the P&I Club maintains a fixed amount of fund which is used for the settlement of claims.

The P&I Club maintains this fund through the payments of the advance calls and supplementary calls from the members.

Some part of this money is also invested to earn some profit which again goes into the fund. This all becomes the income part of the P&I club.

So in short, the income part of the P&I club include

- The Annual contribution from the members.

- Contribution of new members or new ships entering the club

- Interest/Profit earned on the investments of the fund

Expenditures

It is too obvious to say that P&I clubs will have many expenditures. The major chunk of which goes in the settlement of claims against its members.

Apart from that, another expenditure of the P&I clubs is the management cost of running the club. Management cost would include the salaries of the employees and rent of the offices etc.

P&I clubs also reinsure some of its risks. The cost of such reinsurance also comes under expenditures.

So the expenditure part includes,

- payments made as claims settlements,

- Management costs

- Reinsurance costs

Balance of Income and Expenditures

Once the incomes and expenditures are known, the balances are just the game of addition and subtraction.

At the end of the year, the amount short of the agreed amount to maintain in the fund is contributed by each ship owner.

The contribution paid by a ship owner is equal to the “call rate” multiplied by the total gross tonnage of his ships insured by the P&I club.

The call rate would be different for different owners and for different ships.

The call rate for a ship owner depends upon factors like

- past history of claims of the ship owners

- the age of the ship

- crew proficiency and knowledge

- trading patterns of the ship

International group of P&I clubs

I know we don’t hear this terms quite often. But there is this group of P&I clubs that plays an important role in the third party claim insurance.

This is the group of 13 P&I clubs. All these P&I clubs are bound by the agreement called “International Group Agreement“.

The purpose of this group is to

- set the rules of engagement and cooperation between the clubs

- provide a unique and invaluable forum for sharing information on matters of concern to clubs and their members

- Provide a pooling agreement between clubs for claims exceeding USD 10 million

So any claim that exceeds USD 10 million, the excess amount will be shared by the member clubs of this group.

As this is a huge group, it allows the group to economically share the large claims.

Conclusion

It is not uncommon for the seafarers to deal with P&I club correspondents. When there is a claim or an incident, we are asked to call for the attendance of P&I club representative.

If we know how the P&I club functions and more importantly that they are on our side, dealing with these situations becomes easy.

This makes the knowledge about the functioning of P&I clubs so much important.

Share this:

About Capt Rajeev Jassal

Capt. Rajeev Jassal has sailed for over 24 years mainly on crude oil, product and chemical tankers. He holds MBA in shipping & Logistics degree from London. He has done extensive research on quantitatively measuring Safety culture onboard and safety climate ashore which he believes is the most important element for safer shipping.

Search Blog

59 Comments

Dear sir, well explained and easy to understand. Thanking you!

Thanks, Raman...

Dear sir, if a ship hits a fishing vessel and loss of life of fishermens, then who will contribute for the loss and wat s the limit. thanking you.

As this will be a third party claim, P&I club will pay on behalf of the shipowner. There is no limit of liability in these cases. The fishermen's family would file the criminal case and shipowner and seafarers involved need to contest that.

Great information Sir. Request you to kindly answer my query.. Why Marine insurance is called Marine insurance Act?

That is because, like any other type of insurance, marine insurance too need a law (Act) to govern it. For example, if there is no law, the insurer may simply deny the claims made to him by the assured. Or the assured may not disclose the true picture and still claim the huge money from the insurer.

Sir, Can you explain 4/4 Rdc and LLMC 1976 and liability settlement-single liability settlement and cross liability settlement I.e difference between two?

4/4th RDC is from P&I and it Means that in collision cases, any liability towards other V/L will be covered by P&I. H&M will only cover the damage to own V/L. If an owner chooses 4/4 RDC, the premium of P&I would increase and H&M would decrease. Cross liability is a bigger topic and I will write a post on that...

I start my job as a marine cargo surveyor , Would you explain to me how i can got a job (business)or( to work with) from P&I club in my town.( none can advice right here in town.)

Thanks in advance.,

Very useful. But would like to know the types of cover the P&I clubs provide to its members and the costs associated. Thank you

Sir, can you please write a blog on cargo insurance and inchmaree clause of H&M insurance

I have been an Insurance Manager for a shipping company of 10 vessels for more than 5 years. I have never seen such matters explained in such a simple and comprehensive way for those needing to know the basics (you even had a small / simple adjustment as a example!). Presenting these matters is such a way, shows solid knowledge on the specific topic and the kindness to share it with the shipping community. Congratulations from a fan from Greece!

Found your blog. Its really valuable for worldwide shipping services. I appreciate your article. Its important for ge good informations on worldwide shipping services. So thanks for sharing all that important information.

Wonderful and compact explanation ,thank you sir

Very useful article. i really love this. Thank you for your sharing this wonderful post. http://www.harikengineering.com/

What happens when a vessel owner is involved in an offshore incident such as an engine room fire that eventually caused an oil spill due to delayed responders and US government agency deems the vessel owner as not being compliant with US federal laws which subject the vessel owner to unlimited liability. Will the P&I club pay out the claim or will it be denied?

Does a charterer need to secure its own P&I if the ship already has P&I. I am worried about dock suing the charterer if the vessel damages the dock.

No, charterers will not be responsible for this and hence no claim can be made against the charterers. The claim will be for ship owners or ship manager. The P&I insurance taken by them would be enough for that.

Dear sir pls advice on below FO hose was connected to DO line. Bunkering commenced. Blunder was realised moment later. Huge claims on part of the ship itself. Who will pay for this claim. TIA

Sir can you please explain relationship of P&I insurance and GA with any example?

Very well explained. So much clarity and in depth, in very simple language free of jargons

Thanks Sanjiv...

Dear Captain, your explanation is fully noted. However, i am a little bit confused on one thing. The first instance, you said that P&I clubs works on a non-profit basis but at the second you said that the Club will earn the income from the invested fund. The first and second statement sounds inconsistent, could you please clarify? your response will be highly appreciated.

Even when P&I club earns the income by investing the money, the profit is one way shared by the ship owners itself as it reduces their premium.

Dear sir, what is protection and what is indemnity? Can explain in details.

hello sir, May I know what is the validity of the Certificate of entry ?

Certificate of entry is generally valid until 20th of Feb. So the Validity is one year if it is issued 20th Feb and less than one year of issued after 20th Feb (such as in case of a new ship or change of P&I club).

Hi sir! Thank you for sharing this information. I have one question, how can I become a p&I club communicator? I don't really find any complete information on Google. I am a full rights lawyer in my country ( Romania) and also a student at the marine University( last year ) in my country and I would love to add both law and marine into my work What would be your advice as an experienced captain? Kind regards

Thank you for such clear info. I see the needs for PI if you are a ship owner. But what of freight forwarders or ship agents or brokers? Can they avail of PI club? Many thanks

Brilliant explanations with ease of language. It cleared so many doubts.

Sir If there is two ships and one is insured and other and both gets collided with other than but only one ship get damaged.Than P/I WILL pay 3/4th directly to one who is damaged why not 100%

Sir, Why only 3/4 th is paid by the H & M not 100%..and if 3/4th is paid by the H&M than who will pay remaining 1/4.Shipowner or P/I. and if shipowner dont have that much money to pay.than who will pay and in that case if p/i pay than why will he pay????

H&M generally cover 3/4th of Collussion Liability. However in some cases, the cover can be extended to 4/4th (i.e. Full) with additional premium. If shipowner does not have P&I cover, and unable to pay, ylou need to approach court to get appropriate Court otder to get the ship attached and sold to recover the amount.

Your this particular article is very useful for me. Thanks for all these valuable information.

Dear sir, we introduce myself .I am MS leader marine overseas (Myanmar)Co ltd in Myanmar.Our group holding with SRPS certificate and provided Taiwan vessel The ship owner issue Epandi insurance .The vessel sank of 2,1.2019 Taiwan water.Our group crews missing 14 crews,still not p&I cover yet. Already informed ship insurance broker and third party.Why delaying cover of reason? Please explain us.

Dear sir, Up post ,we study Insurance certificate valid June 1918 to jun 1919. Soon expire search certificate. How process early insurance cover for missing crews cover?

Sir really very thanks for all this informations. Sir can you please give some informations about local P & I correspondence.

Great , very nicely explained thanks

Sir, in case of collision, the repair cost of ship A, ie.100.000 USD will be also paid by H &M insurance in full after paying 3/4th liability of A towards B?

Sir, good explanations. I have question about overspill call, how it is contributed between international pooling agreement, limits of claim by individual club and international group of clubs

Sir, good explanations. I have question about overspill call, how it is contributed between international pooling agreement, limits of claim by individual club and international group of clubs

What is a catastrophic call?.

Thanks for this amazingly explained information, easy to understand. I had a lot of questions about these P&I and H&M insurances, now you made everything clear.

AM GLORIA , A STUDENT OF REGIONAL MARITIME UNIVERSITY,YOU ARE TOO MUCH, THE UNDERSTANDING OF P&I CLUB IS COOL.MY EMAIL...abakahgloria11@yahoo.com

As usual very informative....please right on marine lien and arbitration....

Can you elaborate “So if these defenses apply to a case, the shipper would have nobody to claim these damages from.This is the reason that shipper insures the cargo at each leg of the voyage”?

captain the article it was really helpfull.now i know and i understand all about p&i clubs and how it works thank you very much!

Nice blog Sir

Nice explanation Sir , especially your narration style of first few line .

Can a crew join a ship which is without PnI coverage? Working in Port limit. Private insurance would be given by the company

Common between h & m and p & I club

Thank you very much for writing on this! It is so well explained that I could understand it in one read.

how p&i club collect fund from ship owner?

An insurance card template can be used to help you keep track of your policy information and to store other important documents related to your insurance. Insurance Card Template- How To Get

I’ve read a few excellent stuff here. Certainly worth bookmarking for revisiting. I surprise how a lot effort you place to make this sort of excellent informative website. from satta fast

Does P&I covers claims against injury/loss of life of stevedors, shore labourers when engaged in duties to ship which is member of P&I club?

Leave Comment

More things to do on myseatime

MySeaTime Blogs

Learn the difficult concepts of sailing described in a easy and story-telling way. These detailed and well researched articles provides value reading for all ranks.

Seafarers Question Answers

Ask or answer a question on this forum. Knowledge dies if it remains in our head. Share your knowledge by writing answers to the question

MySeaTime Podcast

This podcast on the maritime matters will provide value to the listeners. Short, crisp and full of value. Stay tuned for this section.

Respected SIr, Very use full article . Following are the areas were there is confusion who will pay for these cases P&I or H&M , : Piracy , General Average (some say P&i and other H&M), contact with Jetty,pier,other installation, Delays and Fines by authorities.

H&M is the insurance for the hull and machinery of the own vessel (except for collision cases where it pays for the 3/4th of the liability towards the other vessel). P&I is insurance for the claims from the third party. If you apply this to all situations, it should be clear. For example contact with jetty, if it involves repairing of the own vessel that would be from H&M but if the port claims for the damage to the pier, that would be covered under P&I. Hope that clarifies.